If you are facing bottlenecks in the insurance claim settlements, use insurance flow charts. These diagrams will identify gaps in the entire process.

From claim reporting to claim closure, insurance process flowcharts ensure transparency. Let's discover how these visuals are paving routes for efficacy.

Imagine coming home after a relaxing trip and finding your house flooded due to a burst pipe. The damage is sizable, making you feel tense. It is where insurance comes in to offer relief and financial support. To seek compensation for covered losses, you must go through the insurance claim process.

The insurance process flow chart is a powerful approach to simplifying the entire process. In this article, we will know the importance of insurance process flow diagrams. Also, our main focus would be how they smoothen the complex insurance operations.

An insurance claim involves asking your insurance company to help you with a specific financial loss or damage. It's like making a formal request for them to provide support. You can ask for compensation after an occurred accident, theft, or other covered event. The insurance company reviews your claim and checks the details. It then decides whether you qualify for coverage. After checking everything, they provide you with the necessary compensation. The amount of the claim depends on your policy.

The insurance claim is a sequential process containing the following steps:

In this step, the policyholder informs your insurance company about the incident. He files a claim, providing relevant details.

Documentation

The company gathers and collects all necessary documents and evidence. They can include photos, police reports, and witness statements.

An insurance adjuster assesses the claim. He determines the extent of coverage and validity.

Coverage Check

The insurance company verifies the client's policy. It is necessary to ensure the claim is covered under the terms.

Settlement Offer

The insurer proposes a settlement amount based on the policy coverage and damages. The company negotiates with the client on specific coverage.

Claim Payment

Once the settlement is agreed upon, the insurance company issues the claim payment.

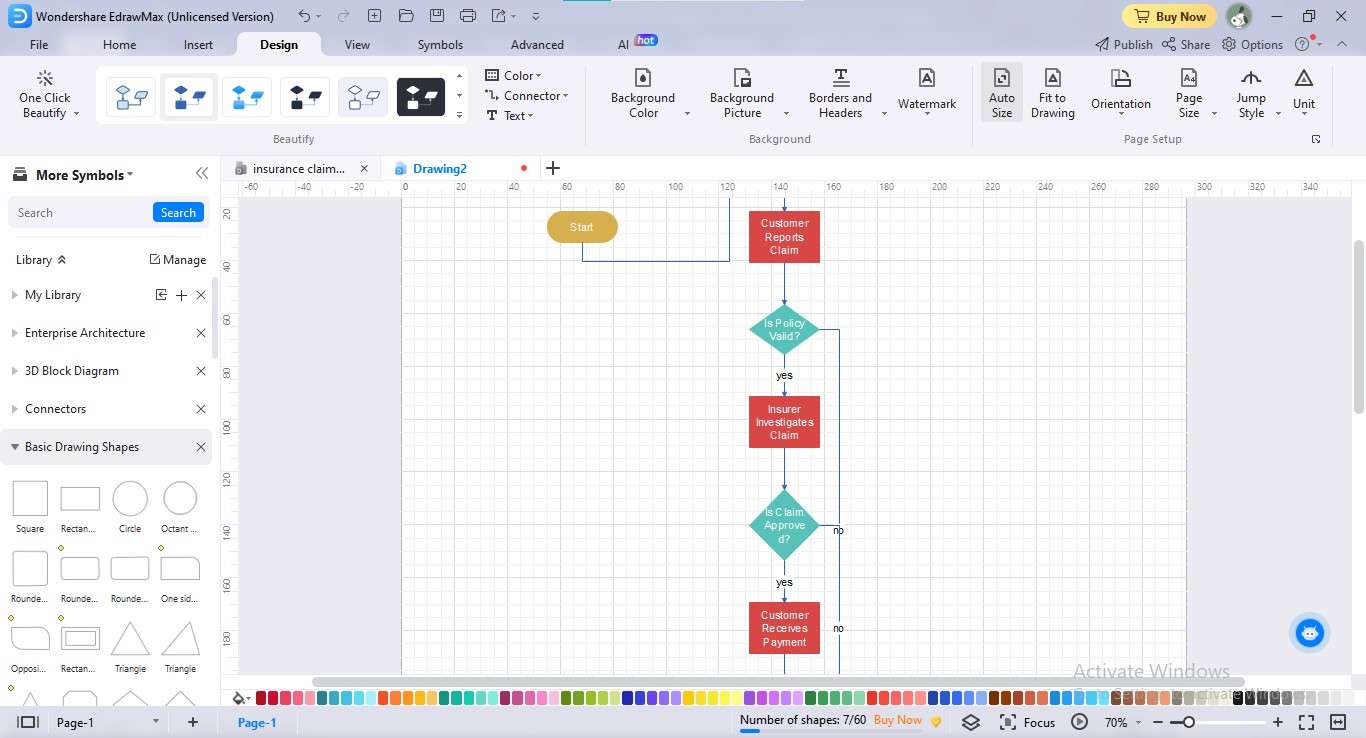

An insurance claim process flowchart illustrates the steps to submit and handle claims. It shows the sequence of activities in order. Companies also define decision points and interactions between different parties through these charts. Using these flowcharts, they perform the entire process smoothly. Insurance process flowcharts help improve customer experience. They also lead to quicker and more accurate claim settlements.

Insurance has a myriad of policies, claims, and processes to understand. To simplify this journey, we have offered some insurance flowchart templates. Let's dive in:

The above flowchart template shows the insurance claim process of a company. The company claims $1000 on car coverage. The company will deny the fund if insurance does not cover the claim. In this case, the insurer will be responsible for any incurred expenses. In contrast, if the insurance policy covers the claim, the company will provide support.

Users can modify or add some amount to an existing insurance policy. This strategy is called an endorsement. In the above image, two users are requesting endorsement. Endorsements provide flexibility in the insurance claim. Also, it allows clients to tailor their insurance policies to suit their changing needs.

The process of health insurance begins with the user getting health insurance policies from insurance providers. Once the policy is in effect, the client can visit healthcare providers. They can seek medical services. When the patient gets medical service, the healthcare provider sends the claim to the insurance company. This claim is on behalf of the policyholder.

The insurance company reviews the claim. It also checks whether it aligns with the policy's coverage. If approved, the insurance company will reimburse the healthcare provider. Besides, the user may be responsible for any applicable deductibles.

The insurance process involves registration and documentation. You need to submit the required documents, such as medical bills and receipts. All these documents are essential to support your claim. The insurance company then processes your claim. It reviews and investigates it for policy coverage.

Once approved, the claim is settled. The company either reimburses you or pays for the loss directly. In case of any incorrect details, the company can repeat the claiming process. Insurance with a reliable provider offers peace of mind. It is financial protection during emergencies.

The medical insurance process begins with the employer offering you a claim form. You need to complete the necessary details. The employer then forwards the form to the insurance company. Within 14 days, the company will inform you of your claim status. If your claim is accepted, the company will grant you the claim.

In contrast, if your claim is denied, the insurance company will give reasons for the rejection. In this case, you can contact them for further information. In case of delays, the investigation may take up to 90 days to reach a resolution.

Insurance companies try their best to improve their claim settlement. They receive many claims daily. Thus, managing them manually becomes time-consuming and error-prone. If you are one of them, you can create an actionable flowchart.

Creating an insurance claim process flowchart reduces human effort. It also decreases the chances of glitches. However, designing a practical flowchart from scratch can be daunting. Fear not, because we have EdrawMax for you.

EdrawMax is a versatile tool for creating marvelous insurance claim flowcharts. You can go for your desired flowchart template to proceed. The extensive symbols library offers relevant icons for precise representation of each stage.

You can ensure consistent and visually appealing designs with just one click using built-in layouts. The flowchart maker tool is user-friendly for beginners because of its drag-and-drop option. The greatest perk of EdrawMax is the introduction of AI functionality. The AI content and diagram creation have transformed the user experience altogether.

EdrawMax doesn't put stress on your senses. The neuro-intuitive platform is understandable, even for a beginner. You can create an intended flowchart manually or via its AI Flowchart feature. We will describe both processes in detail.

Follow the steps below to craft your insurance workflow manually:

Download the "EdrawMax" application. Launch it on your system. Sign up to create your insurance flowchart.